Editor’s note: This is the first part of a 2-part column series provided by Artie Bernaducci.

Editor’s note: This is the second part of the 2-part column by Artie Bernaducci.

Who is Eligible for Widows / Widowers Benefits from Social Security?

Suppose a couple was married for at least nine months or more, and the deceased spouse had worked long enough that at their retirement, they would receive their own Social Security (even if they had not yet started to receive these benefits). In that case, the survivor will be eligible for a widow or widower’s benefit.

Social Security also provides widow/widower benefits for ex-spouses. In this case, if you were married to your ex-spouse for at least ten years, and you did not remarry before you reached age 60, then you would be able to collect a Social Security widow/widowers benefit based on your deceased ex-spouse’s work record. (This is the case, even if your ex-spouse remarried).

How Do You Apply for Social Security Benefits Based on Your Former Spouse’s Record?

There are several different ways to apply for Social Security benefits as an eligible divorcee or widow(er). These include:

- Online

- By phone

- In person at your local Social Security office

To apply online for Social Security, go to: www.ssa.gov/benefits/forms/ and click on the tab titled: Retirement or Spouse’s Benefits to apply for a divorced spouse’s benefits. (If you are applying for widow or widower’s benefits through Social Security, you may not do so online).

Alternatively, you can call the Social Security Administration toll-free and apply for benefits over the phone. The number is (800) 772-1213. A TTY (text telephone) device may also be used if you have trouble hearing. To apply for Social Security benefits via phone using a TTY, you can call (800) 325-0778.

There is also the option of visiting a local Social Security office to apply for benefits based on your former (divorced or deceased) spouse. It is not required for you to make an appointment. However, if you call ahead and schedule a time, it could reduce the time you have to wait to speak with a representative.

When applying for your Social Security benefits, there are some documents that you may need to provide to show that you are eligible. For instance, depending on which type of benefit you are applying for (divorced spouse’s or widow(er)’s), some or all of these may be required:

- Birth certificate or other proof of birth

- Proof of U.S. citizenship or lawful alien status if you were not born in the United States

- U.S. military discharge paper(s) if you had military service before 1968

- W-2 form(s) and/or self-employment tax returns for the past year

- Final divorce decree, if applying for benefits as a divorced spouse

- Marriage certificate

- Proof of the worker’s death

Social Security will accept photocopies of W-2 forms, self-employment tax returns, or medical documents. However, original documents are required for most of the other documents, such as your birth certificate and a deceased spouse’s death certificate.

There are also several questions that you will be asked when applying for Social Security, such as:

- Your name (and your name at birth, if different)

- Your gender

- Your Social Security number

- Your date and place of birth

- Whether a public or religious record was made of your birth before age 5

- Your citizenship status

- Whether you or anyone else has ever filed for Social Security benefits, Medicare, or Supplemental Security Income on your behalf

- Whether you have used any other Social Security number(s)

- Whether you became unable to work because of illnesses, injuries, or conditions at any time within the past 14 months

- Whether you were ever in the active military service before 1968, and if so, the dates of service

- Whether you or your spouse have ever worked for the railroad industry

- Whether you have earned Social Security credits under another country’s social security system

- Whether you qualified for or expected to receive a pension or annuity based on your employment with the Federal government of the United States or one of its States or local subdivisions

- Whether you are currently married and, if so, your spouse’s name, date of birth, and Social Security number

- The name(s), date(s) of birth, and Social Security number(s) of any former spouses

- The date(s) and place(s) of each of your marriages, and for marriages that have ended, how and when they ended

- The name(s) of any unmarried children under age 18, age 18-19 and in elementary or secondary school, or disabled before age 22

- The name(s) of your employer(s) and/or information about your self-employment and the amount of your earnings for this year, last year, and next year

- Whether the Social Security Administration may contact your employer(s) for wage information

- The month you want your Social Security benefits to begin, and

- If you are within three months of turning 65, whether you want to enroll in Medicare Part B.

You may also want to have your bank or credit union information available (such as your checking account number and routing number) so that you can sign up for a direct deposit of your Social Security benefits.

So to wrap up all the information you just read about, the page that follows is our Social Security Income Maximization Checklist that will help you put together your plan.

The Six-Step Social Security Income Maximization Checklist

| Steps | Why this is important | Done |

| Determine which type(s) of Social Security benefits you are eligible for | Even if you have never worked outside of the home, you could still be eligible for spousal, survivors, or even divorced spouse’s benefits. | |

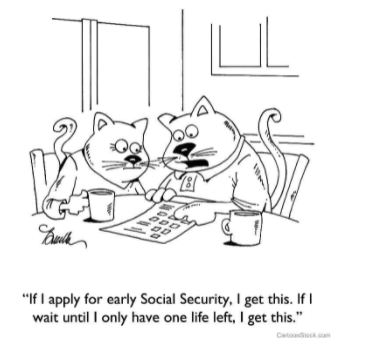

| Decide when you want to start receiving Social Security | Although you may start your benefits before your full retirement age, if you do so, the dollar amount will be permanently reduced. | |

| Determine whether (and how much) your Social Security benefits may be taxed | If you are collecting Social Security and still working, you may risk having up to 85% of your benefits subject to income taxation. | |

| Gather all of the information and documents you need for the application process | Having everything on hand can help to ensure that the application process won’t be delayed. | |

| Talk with a financial advisor who can help you see whether or not there are any “gaps” in your retirement income plan (and, if so, can help you with strategies for filling them in) | Not knowing whether you’ll have enough income to cover your expenses in retirement could lead to an income “gap.” | |

| Contact the Social Security Administration and apply for benefits | You can contact Social Security online, in person, or toll-free by phone. |

Need More Information about Social Security Benefits for Divorced Spouses?

If you are divorced or widowed, the more you know about how Social Security works for those who no longer have a spouse, the better equipped you will be to start collecting the retirement income benefits you are eligible for.

Before you apply for any type of Social Security benefits, though, it is always recommended that you first discuss your options with a financial professional who can help you determine which type of Social Security retirement income would be best, based on your specific financial goals and objectives. That way, you can be more assured that your benefit income from Social Security will fit in with your overall plan.

For more information or questions you may have, please call (732) 508-7400 or email artie@retiring-boomer.com.

Sources

Hymowitz, C. (2016, September 29). Older Americans are Jeopardizing Their Retirement with Divorce. Bloomberg Businessweek. http://www.bloomberg.com/news/articles/2016-09-29/it-is-not-just-brangelina-taking-a-financial-hit-with-late-divorce

Benefits Planner: Retirement. If You Are Divorced. Social Security Administration. https://ssa.gov/planners/retire/divspouse.html

Form SSA-2 / Information You Need to Apply for Spouse’s or Divorced Spouse’s Benefits. Social Security Administration. https://ssa.gov/forms/ssa-2.html

Retirement Benefits. Securing today and tomorrow. Social Security Administration. 2019. https://ssa.gov.pubs/EN-05-10035.pdf

We are an independent financial services firm helping individuals create retirement strategies using various insurance products to custom suit their needs and objectives. Insurance product guarantees are backed by the financial strength and claims-paying ability of the issuing company. We are not affiliated with the Social Security Administration or any other government agency.