Words: Artie Bernaducci, Retirement Income Advisory Group, LLC Photo: Glasbergen,

The physical work a mason does is hard enough and adding to that the tax you pay can also make it seem even harder!

I always remember coming home tired at night and when April 15th came and it was time to pay taxes again, it bothered me that I wasn’t able to keep more for myself, not to mention when I would retire.

So, in this article, I want to explain something that often doesn’t get much attention until you get closer to retirement and is…

Is Your IOU to the IRS Growing?

Well, it is if you’re saving money in tax-advantaged accounts like traditional IRAs and/or employer-sponsored retirement accounts like a 401(k) or 403(b) plan. That’s because in most cases, your contributions that go into these types of accounts have NOT been taxed yet.

In addition to that, the funds that are inside these accounts are allowed to grow on a tax-deferred basis – meaning that you aren’t required to pay any tax on the gain while the money is still inside of the account.

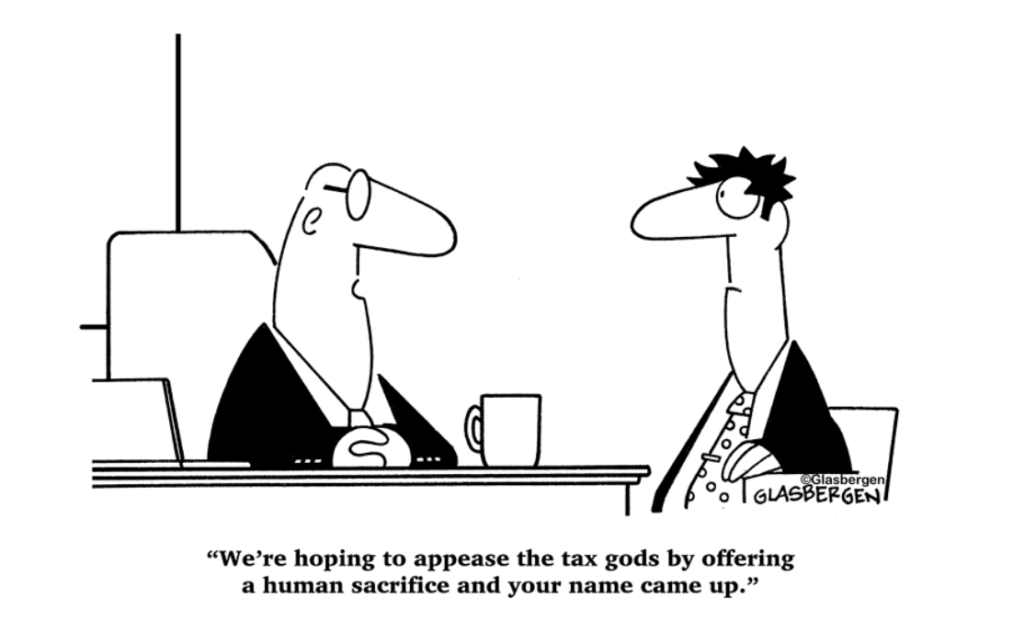

But we all know that Uncle Sam doesn’t give anything away for free. So, while you may get a tax break up-front, he is waiting for that money to grow so that he can take his portion from a potentially larger “pool” of assets.

And he’s not only adamant about making sure you leave the money in the account until it’s had time to accumulate, but he also knows exactly when he will start getting his portion of his (i.e., your money.)

For instance, if you withdraw funds from your 401k or IRA accounts (other than with very few exceptions) before you turn age 59 ½, you’ll not only have to pay tax on the gains in it, but you will also incur an additional 10% “early withdrawal” penalty from the IRS.

But the other side of the coin is that you also can’t leave money in these types of accounts for “too long,” either, because once you turn age 72, you’ll have to start taking required minimum distributions (RMDs) whether you need the money or not.

What happens if you don’t?

You’ll face a penalty from the IRS!

If you fail to take your RMDs, you can face a penalty tax of up to 50% on every dollar that you did not withdraw. That can make a difference in how much you put in your pocket and how much Uncle Sam puts in his.

Take this hypothetical example of John. John is 74 years old. He has a traditional IRA account with a balance of roughly $200,000. Because John receives income from a rental property he owns, as well as from some side consulting jobs, he doesn’t need to tap the account to meet his living expenses.

Unfortunately, though, by NOT taking money out of the IRA, it will cost him! That’s because when John turned 72, he should have begun taking his RMDs from the IRA. In this case, John’s distribution for the first year should have been $7,800.

When RMDs are not taken (or not fully taken), any of the shortfalls will be subject to a penalty of 50% from the IRS. So, in John’s case, by not taking any money out of the IRA that year – when he should have taken at least $7,800 – it “cost” him an additional 50% penalty of $3,900!

OUCH, that hurt!

Based on the provisions in the SECURE (Setting Every Community Up for Retirement Enhancement) Act, which took effect on January 1, 2020, Uncle Sam now requires you to take at least a minimum amount out of traditional IRAs and employer-sponsored retirement plans when you turn age 72, however, the entire balance must be distributed after the 10th year. *

Before 2020, RMDs were to begin at age 70 ½. At that time, investors were also no longer allowed to make additional contributions to these plans. Starting in 2020, though, the maximum age for traditional IRA contributions has been eliminated. *

But Uncle Sam could also benefit from that new rule, too. That is because even though you can keep contributing to these accounts, the result could cause you to pay even more taxes on your distributions.

Why?

Because the money in the account continues to generate tax-deferred gains…all of which will be taxable when they’re withdrawn.

The good news is that you do have some options for avoiding taking RMDs, as well as eliminating the income tax on income and withdrawals. These strategies may allow you to know exactly how much you’ll be able to spend on the goods and services you purchase in retirement, as well as for fun, travel, and entertainment.

Are There Any Tax-Free Retirement Income Options?

Yes, there are several. However, I will attempt to make this as clear as possible without getting into the weeds of financial mumbo-jumbo and just discuss one of them.

The ROTH IRA came into existence roughly 20 years ago. They are funded with already-taxed dollars, and contributions to Roth IRAs are not tax-deductible, but because you’ve already paid your taxes upfront, you don’t have to pay them later on when you take money out for income in retirement.

The funds in this type of account are allowed to grow tax-free, and the withdrawals are also tax-free. This means that, regardless of what the then-current tax rates are, you won’t owe anything to Uncle Sam when you make withdrawals from a Roth IRA.

One of the easiest ways to think about ROTH IRA’s is with a simple analogy of a farmer.

Farmers have to pay taxes just like everyone else, but if you were a farmer and you had your choice, which would you prefer?

Would you rather pay taxes on the seed you put in the ground… or on the harvest that that seed ultimately became?

Because at the end of the day, that’s the difference between a Roth IRA and any account you have that hasn’t been taxed yet like a traditional IRA or a 401k.

On top of that, there are no RMD requirements imposed on Roth IRAs, either. That means that you can continue to let your funds grow tax-free in the account, even after you have reached age 72.

Some parameters must be followed with Roth IRAs, though, in terms of who qualifies and how much may be contributed on an annual basis. For instance, in 2020, the Roth IRA maximum contribution for those who are age 49 and younger is $6,000. If you are age 50 or older, you can contribute an additional $1,000.

Income limits also apply. So, depending on how much you earn, you may or may not qualify to open and contribute to a Roth IRA, or you may only be allowed to make a reduced contribution. In this case, for 2020, the income limits for single tax filers will begin at $124,000 and end at $137,000, meaning that if you earn more than $124,000 your Roth IRA contribution limit is reduced, and if you earn more than $137,000 you won’t qualify to contribute to a Roth.

If you are married and file your taxes jointly, for the year 2020, the limits are $196,000 and $206,000 respectively.

How to Still Open a Roth IRA – Even If You Earn “Too Much” Income

If you earn too much to contribute to a Roth IRA, you may still have the option to take part in this tax-advantaged account indirectly by going through the “back door.” A backdoor Roth IRA is a conversion of traditional IRA assets into a Roth.

If you go this route, you will have to pay taxes on the gains from the traditional IRA. But through the Roth IRA, you will be allowed to access your funds in the future tax-free.

In today’s low tax environment, it could be worth talking to your tax advisor to see if it makes sense to pay a higher tax today to convert your IRA to a Roth versus doing it later and end up possibly paying more if tax rates increase down the road.

Need More Information About How to Minimize Taxes on Your Retirement Income?

If you are approaching retirement and will soon be withdrawing funds from your retirement plan(s), the more you know about how you may reduce your tax burden, the better equipped you may be at keeping more of your retirement income.

Before you embark on any type of withdrawal or income strategy, though, it is always recommended that you discuss your options with a financial professional who can help you determine the route to take, based on your specific financial goals and objectives. That way, you can align your income with your overall retirement plan.

For additional information on retirement income and how you may retain more for yourself (versus handing it over to Uncle Sam), reach out to me and we can schedule a time to talk. artie@Retire-USA.com (732) 508-7400

Advisory services are offered through Retirement Income Advisory Group LLC, a Registered Investment Advisor in the state of New Jersey. Insurance products and services are offered through The Retiring Baby Boomer Group LLC, an affiliated company. Retirement Income Advisory Group LLC, and The Retiring Baby Boomer Group LLC, are not affiliated with or endorsed by the Social Security Administration or any government agency.

Source: *https://tinyurl.com/y5cwfd29