Software

Construction Accounting Software

Construction accounting software can be the mortar holding your financials together.

Trying to run your business with an off-the-shelf accounting software is like trying to build a brick wall with an insufficient amount of mortar. There isn’t enough holding the wall together, bricks start to loosen, and, soon, the whole wall crumbles. Therefore, it is essential to understand how improved construction accounting and financial management can not only hold your masonry business together, but also become the foundation to greater success and profitability.

In fact, the right construction-specific accounting software can easily eliminate many of the problems encountered by contractors daily. Listed below are five common challenges that contractors face, and how construction-specific accounting software can resolve them.

Problem: You are overly dependent on spreadsheets.

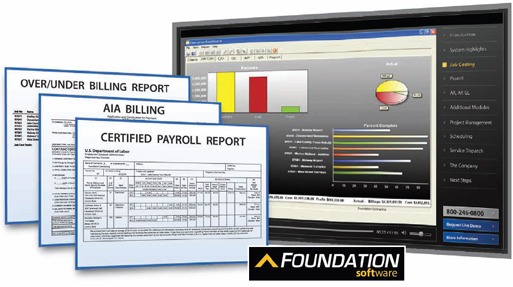

Solution: If you are creating “customized” reports outside of your accounting system for things such as work-in-progress, billings, certified payrolls, job costing, or labor-production analysis, your current accounting system is not meeting your needs. When a system is incapable of providing information the way contractors need to see it, users are forced to re-enter data into separate programs such as Excel. In effect, they are creating a second set of books, which must be continuously updated and maintained with each new transaction, job change, equipment usage, and so on. This increases the time it takes to process data, as well as the risk of errors due to double-entry. With this method, more time is spent gathering information than actually analyzing it, which costs your company time and money.

Contractors should consider a construction-specific accounting system that offers accurate, instant, and extensive reporting capabilities. These systems are usually built upon secure databases and are designed to handle tens of millions of records and multiple users, which means that they can produce reports that can be shared and accessed without tampering concerns. This increases efficiency, and makes sure that everyone is on the same page.

Problem: Processing payroll is time-consuming and difficult.

Solution: Whether you have 10 employees or 300, payroll activities and the reports derived from payroll information can be complex. Off-the-shelf accounting software can generate payroll checks and book the costs to the general ledger, but most packages lack the sophistication to deal with multiple states and localities, varying pay scales, multiple job classifications, union reporting, deductions, withholding and tax reporting, and other construction payroll issues.

There are at least five features that can help automate and streamline the payroll process that only a construction-specific system can provide:

- Timecard Entry. A construction accounting system’s payroll module supports unlimited timecard styles as well as methods of delivery. It should also seamlessly integrate with third-party timecard applications.

- Multi-State, Multi-Locality and Multi-Job Processing. Contractors not only save time on payroll tax processing, but also gain a greater understanding of how and where labor and burden costs are being spent on all of their jobs.

- Job Cost and General Ledger Integration. In order to track and manage job costs effectively, contractors need a system that integrates payroll with general ledger and job costing modules. Integration of payroll data to the general ledger also leads to overhead allocation reporting, which allows contractors to determine the net profit of each job.

- Certified Payroll. The inability to produce certified payroll reports could prevent contractors from bidding on government-funded jobs. Most construction-specific accounting systems instantly produce these reports for any payroll period.

- Standard and Construction-specific Reporting. Software should be capable of generating various federal and state payroll tax reports including year-end W2s, and it should generate on-demand reports like timecard history, detail report by job, and accrued time off. Construction-specific systems offer construction reports, which eliminate the need for manual preparation of Equal Employment Opportunity reports and other reports for government agencies. These systems also include a number of user-defined deductions that allow for instant computation of liability insurance, garnishments, employee loans, 401 (k) deductions, etc.

Problem: Your current software is incapable of producing on-demand job cost reports.

Solution: Creating job cost reports from generic programs is difficult because the applications are not designed specifically for construction. Information that cannot be retrieved quickly is of little use to decision makers or project managers who need time to turn around a job. Robust reporting is the cornerstone of most good construction-specific accounting programs. They typically offer advanced reporting features beyond standard reports like customizable report-writers, and easy data input and export into popular third-party software products.

So what specific job cost reporting features should contractors look for in their accounting software??? There are four basic components that lead to powerful, virtually limitless job cost reporting:

- Job Cost Detail. No matter how complex the job, efficient job costing comes down to how costs are defined and tracked. Users should be able to define any number of phases, cost codes, and cost classes so that they can record and report data as precisely as they need it.

- Reporting Flexibility. Good systems provide a multitude of standard reports and make it easy to customize reporting when needed with built-in report writers. These report writers should allow users to create their own drill-downs, equations, what-if scenarios, and more.

- Date Sensitivity. This feature allows any report???in job costing or any other module???to be run for any time period, even months or years in the past.

- A Powerful Database. How and where data is stored affects reporting capabilities. Data protection and the ability to query capabilities via Excel and other Microsoft products are huge advantages.

Problem: You do not have access to specialty billings.

Solution: In order to maintain the necessary inflow of cash, contractors must select the billing method best suited for their jobs. They bill and collect according to their contracts, they bill promptly and never forget about such items as change orders and retention, and they rely on construction-specific accounting software to automate the entire process.

Construction-specific accounting systems support numerous industry-standard billing methods, and complete integration with job costing, general ledger, and other modules. This creates a single entry system. Good systems will offer users the ability to minimize data entry with default calculations, print on blank forms or directly on pre-printed forms, make adjustments to prior invoices, calculate retainage, define and track sales and use tax, add change orders, and update AIA billings automatically with each application. Construction-specific accounting software allows for several types of billings including AIA billings, time and material billings, unit price, percentage of completion, service, and free-form invoices.

Problem: Your vendor/support team doesn’t understand your industry.

Solution: No matter how good a system is – or how easy it is to use – there are bound to be times when users will have questions or run into problems. Fast, reliable customer support is especially critical for accounting software because an unnecessary delay (in payroll, billing and receivables, for example) can affect more than just productivity. Since software support varies greatly from vendor to vendor, it’s important for contractors to consider the company behind the product.

There are at least six key features that improve the quality of construction accounting software support:

- Live customer support

- A variety of support options

- Fast response time

- Product/industry experts on staff

- Ongoing product updates and enhancements

- Ongoing education opportunities.

Ironically, the characteristics that make off-the-shelf accounting software products so appealing to small contractors are what that actually create problems as a company expands. The software’s limited system features, which make them easier to use, and their limitations to industry-specific features, which make them cheaper to buy, are often the largest roadblocks to accounting efficiency and productivity for growing contractors. Converting to a more sophisticated, construction-specific accounting application may be just the remedy your company needs to build your business higher and stronger.

|

|